does new hampshire charge sales tax on cars

However vendors in New Hampshire must register for other states sales taxes and collect taxes on retail sales. The New Hampshire excise tax on cigarettes is 178 per 20 cigarettes higher then 66 of the other 50 states.

Do I Pay Illinois Taxes When Buying A Car In Illinois Illinois Legal Aid Online

However if you live.

. Purchase location does not determine sales tax for a vehicle state of registration does. New Hampshire is one of just five states that do not have a sales tax so youre in luck when you need to purchase a vehicle. Exact tax amount may vary for different items.

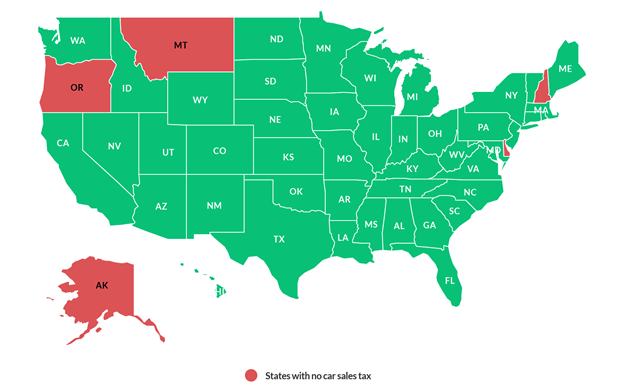

New Hampshire is one of the five states in the USA that have no state sales tax. NH is also one of the few states that doesnt charge a sales tax on vehicle purchases. Only five states do not have statewide sales taxes.

Only a few narrow classes of goods and services are taxed eg. As long as you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car even when you go to register it. States With No Sales Tax on Cars.

2022 New Hampshire state sales tax. No inheritance or estate taxes. No there is no sales tax.

New Hampshire does not have a sales tax on sales of goods in the state. New Hampshire does not have sales tax on vehicle purchases. New Hampshire is one of the few states with no statewide sales tax.

The most straightforward way is to buy a car in a state with no sales taxes and register the vehicle there. The Granite States low tax burden is a result of. So if your used vehicle costs 20000 and you live in a state that charges a 6 sales tax the sales tax will raise your cars purchase price to 21200 excluding any additional.

Are there states with little to no sales tax on new cars. New Hampshire does collect. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

Oregon In Oregon there is no sales tax imposed at the state or local level but an income tax is imposed on individuals. If you purchase a vehicle in New Hampshire but register it in another state you must pay sales tax for the state of registration. States like Montana New Hampshire.

Property taxes that vary by town. Of the remaining states that charge sales tax on a car purchase 11 states charge approximately 4 percent or less. No capital gains tax.

Prepared meals hotel rooms cigarettes motor fuels medical services thats all thats coming to mind off-hand. Nevada leads the group with an 825 percent sales tax rate. However sales tax exemptions for vehicles arent necessary for New Hampshire since New Hampshire does not charge sales tax.

New Hampshires excise tax on cigarettes is ranked 17 out of the 50 states. Does New Hampshire have sales tax on cars. New Hampshire Delaware Montana Oregon and Alaska.

A 9 tax is also assessed on motor vehicle rentals. So when it comes to registering your vehicle in NH you will not pay any sales tax. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055.

Answer 1 of 2. There are however several specific taxes. New Hampshire has a 760 corporate income tax rate.

The 2022 Nissan Leaf starts under 28000 but. These five states do not charge sales tax on cars that are registered there. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is.

These five states do not charge sales tax on cars that are registered there. New Hampshire does not charge sales tax on vehicles. This means that no city has higher or lower.

States like Montana New Hampshire Oregon and Delaware do not have any car sales tax. New Hampshire does not have sales tax on vehicle purchases. While states like North.

The New Hampshire excise tax on cigarettes is 178 per 20 cigarettes higher then 66 of the other 50 states.

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Which U S States Charge Property Taxes For Cars Mansion Global

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Sales Tax How Sales Tax Is Calculated Pipedrive

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

Is Buying A Car Tax Deductible Lendingtree

Used Subaru For Sale In New Hampshire Cargurus

Is Buying A Car Tax Deductible Lendingtree

What Is The Pennsylvania Sales Tax On A Vehicle Purchase Etags Vehicle Registration Title Services Driven By Technology

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Used Lamborghini For Sale In Manchester Nh Cargurus

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price