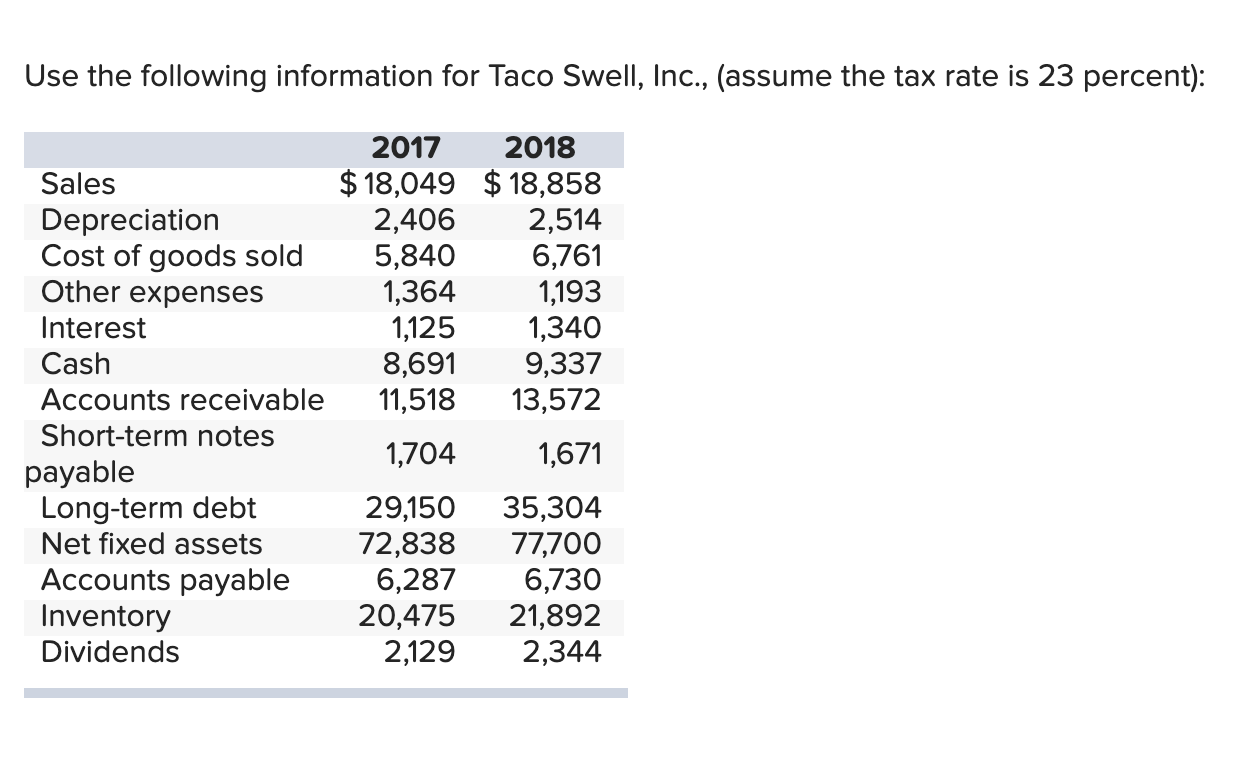

how do you calculate cash flow to creditors

Rated the 1 Accounting Solution. Bettys Blooms Flower Shops had a -26500 cash flow from assets from July to.

Operating Cash Flow Formula.

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

. Pay your credit card bills on time and keep your credit utilization low to use credit cards as a tool for business growth. To prepare the cash flow from Financing we need to look at the Balance Sheet items Balance Sheet Items Assets such as cash inventories accounts. Suppose the operating cash flow of.

Negative cash flow from investing activities might be due to significant amounts of cash being invested in the long-term health of the company. How to Calculate Cash Flow. Creditors have interest in your operating cash flow when deciding whether you are well-positioned to take on additional debt.

Rated the 1 Accounting Solution. The change in NWC is calculated as follows. Basic Formula The basic formula for operating cash.

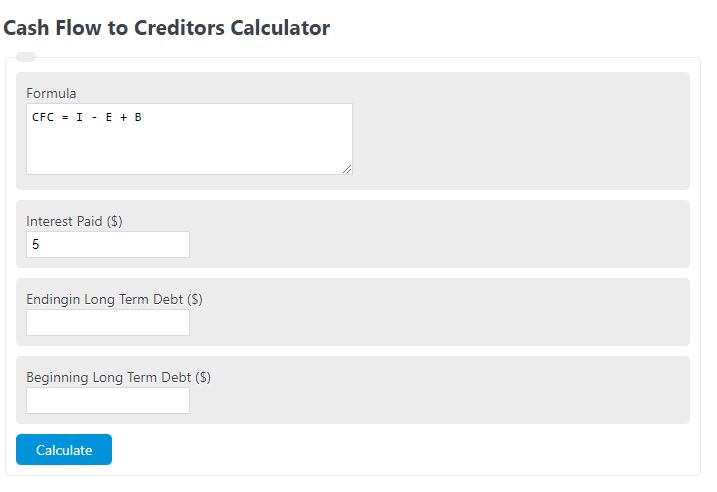

Beginning cash is of course how much cash your business has on hand. Cash Flow From Creditors Example First determine the interest paid. Ad QuickBooks Financial Software.

Calculate FCFF Calculate FCFF FCFF Free cash flow to firm or unleveled cash flow is the cash remaining after depreciation taxes and other investment costs are paid from the revenue. 4 Formulas to Use Cash flow Cash from operating activities - Cash from investing activities Cash from financing activities. Cash outflow is your fixed and variable bills.

Now lets just input all these numbers into a formula. Cash Flow Forecast Beginning Cash Projected Inflows Projected Outflows Ending Cash. 73571 34127 58325 30352 11471.

Heres how to calculate the cash flow from assets. Generally speaking companies want to. 18500 -15000 -30000 -26500.

Is one of the three key financial statements that. Calculate Cash Flow from Financing. Utilize small business loans.

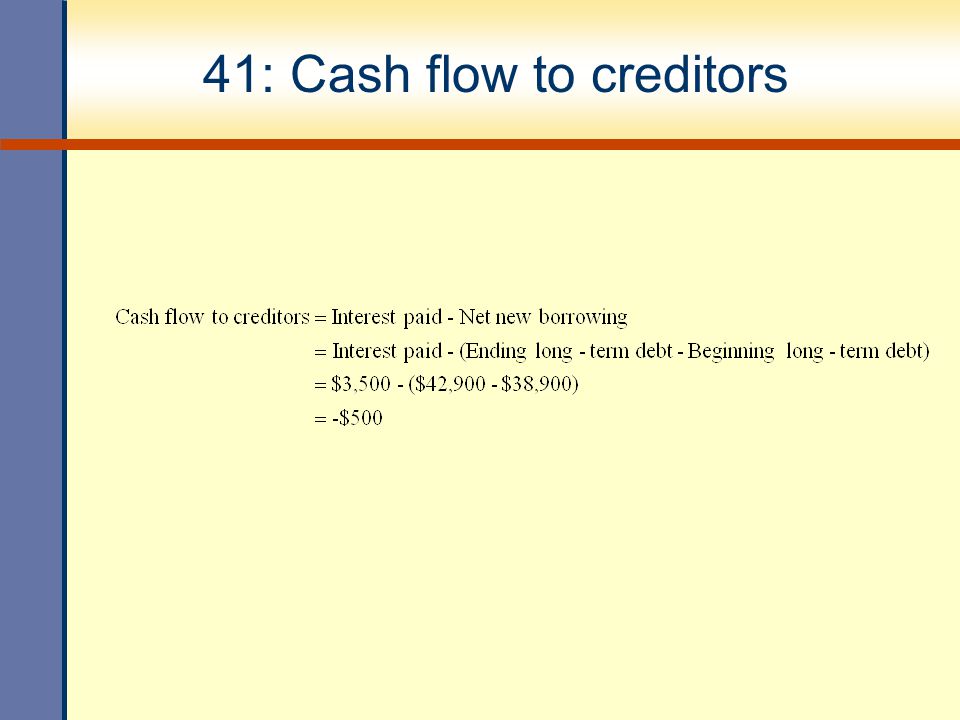

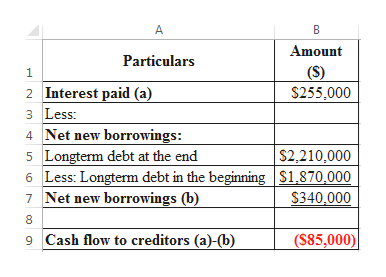

Free Cash Flow 227 million 32 million 65 million 101 million. Cash flow to creditors Interest paid New long-term debt Cash flow to creditors Interest paid Long-term debt end Long-term debt beg Cash flow to. Free Cash Flow Net Income Depreciation Change in Working Capital Capex.

How to Calculate Cash Flow. Calculate the total interest paid. Operating Cash Flow Net Income.

Credit diversity also increases credit score. 4 Formulas to Use Cash flow Cash from operating activities - Cash from investing activities Cash from financing activities Cash flow. A positive cash flow is good for the company as it determines financial success and a negative cash flow says otherwise.

Follow these three steps. Whats left at the end of the month is your net. Your cash inflow is your net income.

Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period. Free Cash FlowNet Operating Profit After Taxes Net Investment in Operating CapitalwhereNet Operating Profit After TaxesOperating Income 1 - Tax Rateand. Take net income from the income statement Add back non-cash expenses Adjust for changes in working capital.

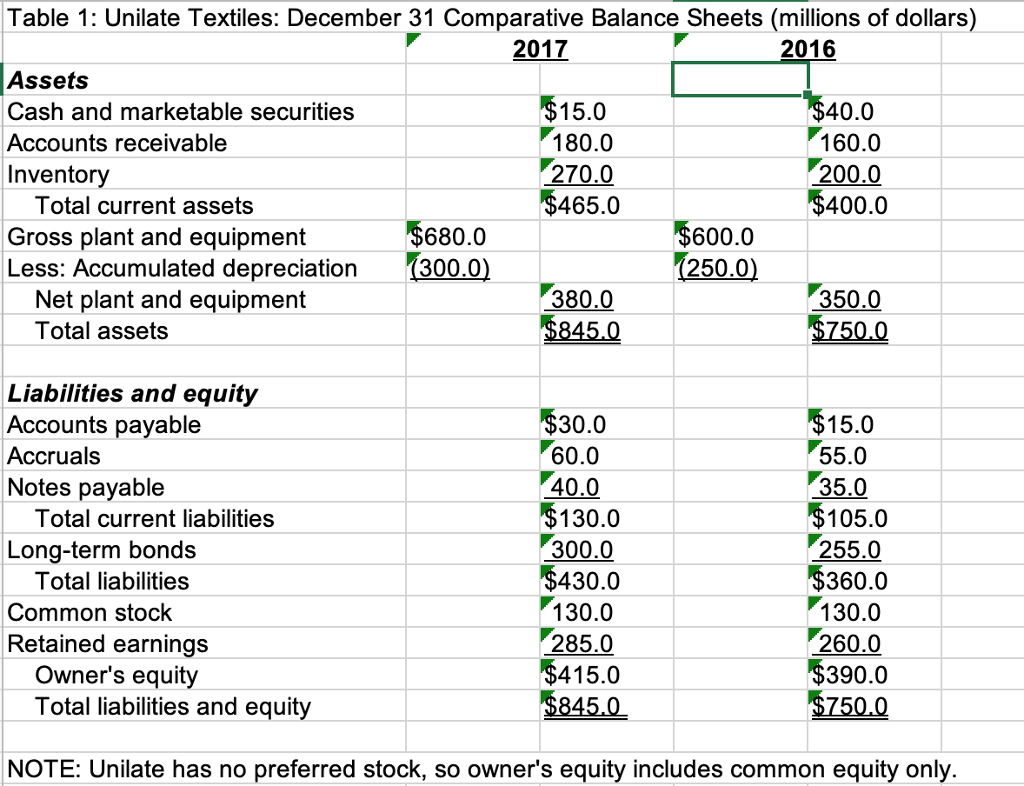

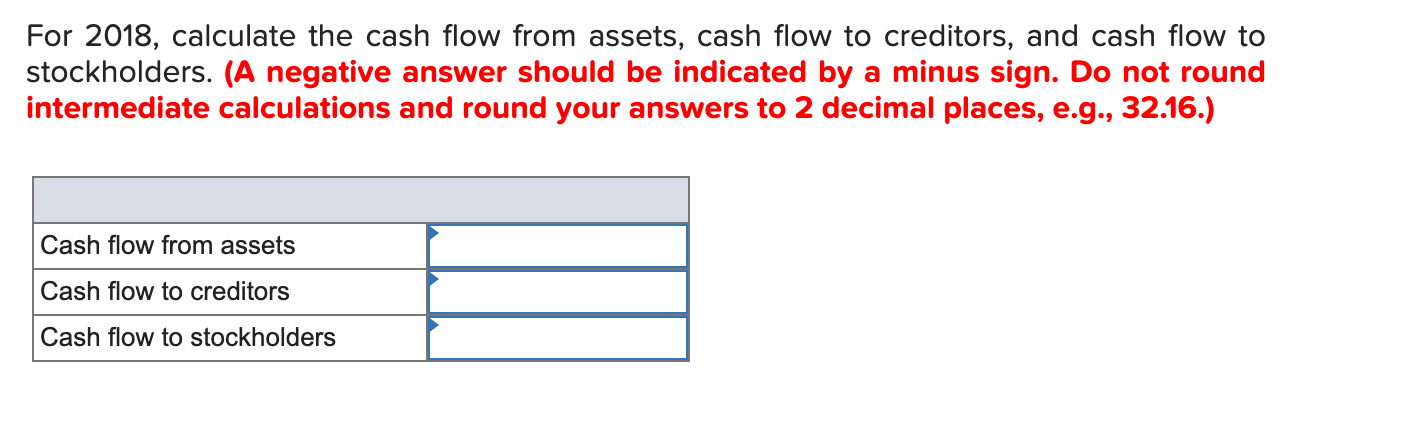

Cash Flow and Average Collection Period The average collection period is used a few different ways to measure cash flow performance. Calculating Cash Flows Calculating Owners Equity Net Working Capital Fixed Assets Long Term Debt and Cash Flow to Creditors Direct and indirect methods of cash flow. Calculator Precision Decimal Places 0 1 2 3 4 5 6 7 8 9 10.

Amount of Interest Paid i Ending Long Term Debt d E Beginning Long Term Debt d B Cash Flow to Creditors Calculator. Cash Inflow Cash Outflow Net Cash Flow. Determine the amount of.

The cash flow to creditors is. Ad QuickBooks Financial Software. Next determine the ending long term debt.

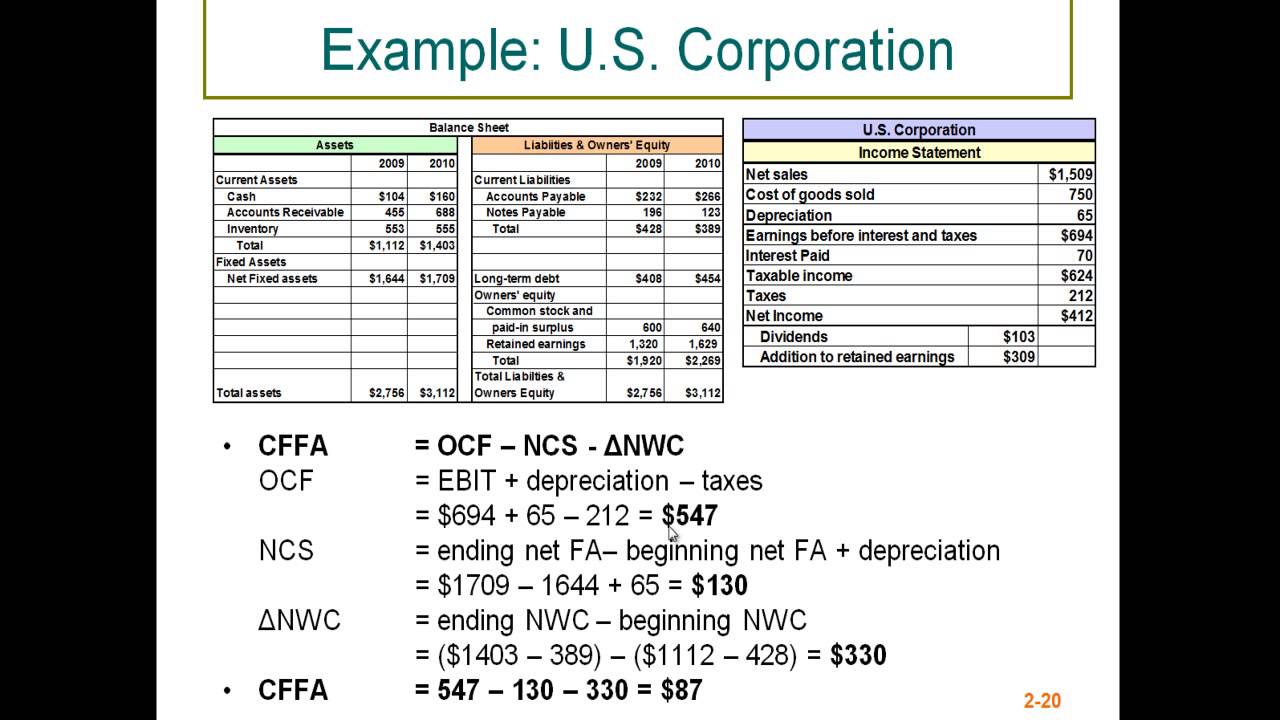

Chapter 2 Financial Statements Taxes And Cash Flow

Solved Calculate The Cash Flow From Assets Cash Flow To Chegg Com

Cash Flow To Creditors Calculator Calculator Academy

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Solved For 2018 Calculate The Cash Flow From Assets Cash Chegg Com

Solved For 2018 Calculate The Cash Flow From Assets Cash Chegg Com

Financial Statements Taxes And Cash Flow Ppt Video Online Download

Cash Flow To Creditors Calculator Calculator Academy

Question 1 A What Is The 2020 Operating Cash Flow B Calculate Cash Flow From Assets Cffa Cash Flow For Creditors Cffc Dan Cash Flow For Course Hero

Solved Use The Following Information For Taco Swell Inc Chegg Com

Answered Cash Flow To Creditors The 2017 Balance Bartleby

Financial Statements Taxes And Cash Flow Ppt Video Online Download

Cash Flow To Creditors Calculator Finance Calculator Icalculator